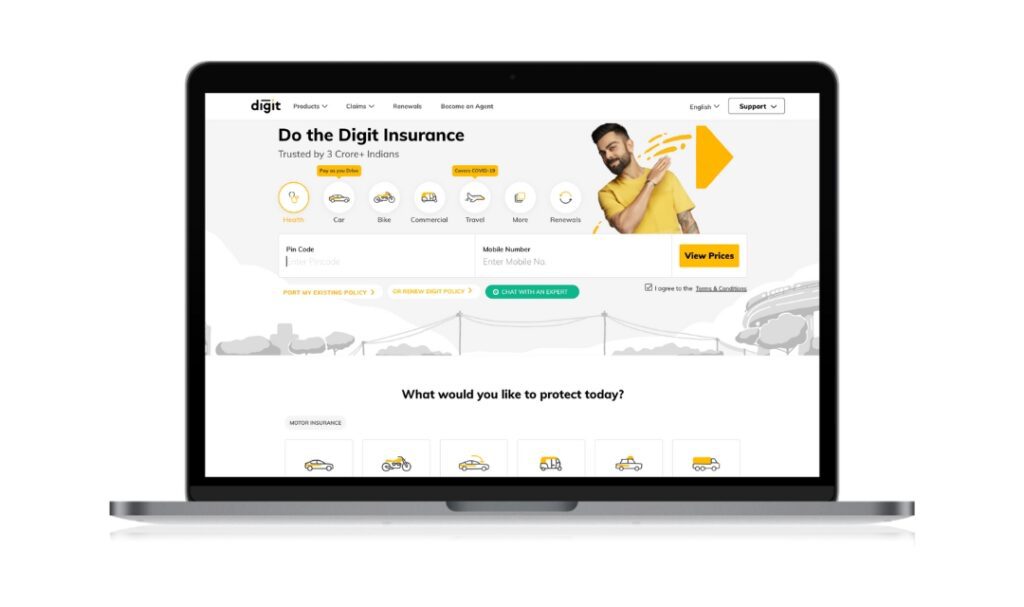

Digit Insurance is a Bengaluru-based general insurance and financial services company. It is on a mission to make insurance simple for the common people. Digit General Insurance has come up with numerous insurance plans that can be primarily categorized as Go Digit health insurance, Go Digit car insurance, Digit 2-wheeler insurance or GoDigit bike insurance for bikes, Go Digit commercial vehicle insurance and Go Digit travel insurance.

Insurance is complicated, but the digit is simplifying it for Indian consumers. Digit Insurance believes that this can be changed; the way insurance products are viewed, purchased, and claimed. Simply put, we are here “To Make Insurance Simple”. With that as our mission, they are reimagining products, and redesigning processes. Going back to the basics and building simple and transparent insurance solutions, that matter to people.

Previously bread had to be sliced from loaves. It wasn’t simpler than today’s slices. People find insurance to be like those unsliced loaves. Customers also don’t understand which plan is appropriate for whom. The company believes that this thinking can be changed. With this Digit Insurance started making insurance simple with an aim to go back to the basics and simpler transparent insurance solutions. Simple meant no twisted rules. The company needed a simple name and hence it found the name digit to be perfect and appropriate for them

The Digit Insurance business model works just like the business models that the insurance companies opt for, the only difference is that Digit aims to introduce a range of new products and services to disrupt the Indian general insurance sector. It holds a general insurance license, which allows the company to sell health insurance products. Car and home insurances are common but Digital Insurance provides jewelry and mobile insurance as well. Furthermore, the company is redefining the insurance industry by working digitally. Its business strategy is to create beneficial partnerships with various companies. Among various other insurance plans, Digit is one of the insurance companies that launched Go Digit Covid insurance. The coronavirus health insurance of the company is similar to a customized health insurance policy, which helps to cover the hospitalization and treatment costs of the Covid-19 infected persons who have previously registered with Digit.

Some of the prominent awards and achievements that Digit insurance achieved throughout the years are:

Digit Insurance grew by 31.9%, earning a premium of $186 million (April’20 – Dec 20), and claimed to have more than 1.5 crore customers since inception. In 2020, the company expanded its business by 30%. Two major products that helped the company drive growth were firstly the Covid health insurance and the other one is fire insurance. The company witnessed strong growth in terms of its premium collection due to the above-mentioned factors. The company has registered considerable growth in its gross written premiums ever since it was founded, which was recorded at Rs 5268 crore in the financial year 2021-2022.

Kamesh Goyal, Chairman

Jasleen Kohli, MD and CEO

Read inspiring stories and profiles of people and businesses making a difference.

The community is helping entrepreneurs to grow their skills, knowledge, and 360° growth.

Udaan Skill Academy is India’s best skill development and learning platform. We are on a mission to empower youth and entrepreneurs.

Udaan is building a community of entrepreneurs, professionals, and students, using real-time industry data to upskill individuals.

© Copyright 2023 Udaan Skill Academy

Our Digital Partner Branndsjet ❤️